So you are short of working capital (cash) for you business:

Is getting an Angel Investor the best option? Most probably not.

Should you get investment ready – definitely!

In most cases, the act of preparing for investment will eliminate the need to raise money. Companies that get investment typically will receive the capital to accelerate growth, not initiate it.

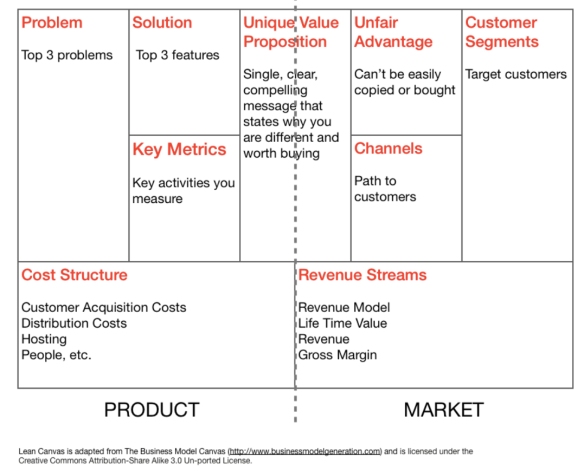

Apart from having a realistic valuation expectation, being “investment ready” is simple, get clarity and focus around:

- Product or service value proposition

- Business model, strategy, and plans

- Having something unique and defendable in your product offering

- Building and maximising the productivity of your team, including governance

- Have customers that buy stuff

There is no rocket science around all this, but I consistently see companies going to the market to talk to investors that do not have their act sorted. Equally so, they are attempting to do too many things with mediocre results.

Now for the reality – raising capital is slow and arduous process. Typically it will take you six to 24 months before the money appears in the bank account and will consume at least 200 hours of your time.

Many businesses seeking capital will go bust before they get there and the more fragile their current position, the more likely it is they will not attract the capital.

Without a clear strategy and go-to market model, you are unlikely to find an investor.

So if Angel Investment is not the magic answer what is?

One of the issues of technicians starting businesses, apart from those raised in my e-myth blog post, is their lack of experience in structuring deals of any type, too often playing with price as the only negotiating tool.

Other options for funding growth include:

- Selling more

- Charging more for your product – what effect would there be by increasing your sales price by 30, 50 or 100%? In many cases increasing sales price will increase sales.

- Establishing better sales channel partners – preferably ones that already have your target market as customers

- Using customers as promoters of your product

- Sharing promotion costs with distributors

- Licensing deals

- Structuring payment options eg. 50% deposit with order

- Debt finance

- Invoice factoring

- Government grants – yes there are still some available

For those who are looking to get smarter around strategy and structuring their business for growth, Debbie Humphrey and I run a four day workshop called Business Dominoes to tackle this very issue.